Overseas marine insurance agent industry has been hundreds of years of history and has been a mature industry. Insurance agent plays more and more important role on insurance market. NJS has paid attention to development of the field since 2008 and has gained certain achievement. Meanwhile, we have gained good cooperation foundation with insurance institution at home and abroad, in particular that we have professionally dealed with happened accident compensation with principle of good faith and best service for vast clients.

The scope of cover for insuer has three aspects including guaranteed risks, reparable loss, bearable cost for insurancecompanies in the marine cargo insurance business.

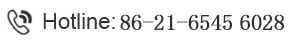

Risk of marine cargos transportation

Risk of marine cargos transportation can be classified as the following chart.

Extraneous risk refers to the risk caused by other extraneous reasons beyond the marine risks.

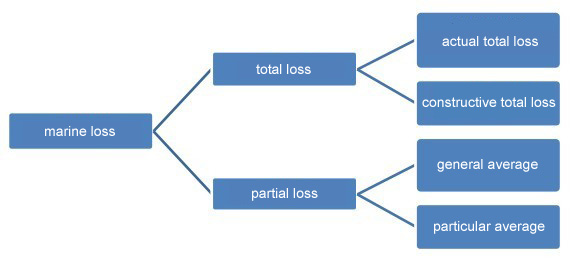

2.Loss

Marine risk can be classified as the following chart

(1) Total loss refers to the total loss of the whole batch of goods or a indivisible shipment of goods on the way of transportation. Total loss is classified into actual total loss and constructive total loss.

(2) Partial loss isn’t belonging to actual total loss and constructive total loss. That is without to the degree of the total loss. Partial loss is also classified into general average and particular average.

Cost born by the insuer is the reasonable expenses paid by the insuer in order to reduce cargos real loss after accident insurance happened.

Rescue cost is the expenses of rescueing accident insurance paid by the insuer or the insuer’s agent, the hirer and the insurance documents the transferee to avoid expansion of the loss during disaster accident among the range of insured liability.

Salvage cost is the remuneration paid by the third party exclusive of the insuer who takes assistant act when accident insurance confronts above disaster accident.

In summary, we pay considerable attention to the practical operation.

NJS must get the correct record from the isuer’s all communication by phone and other concise meetings during our insurance agent service. The key must to get confirmation in the later faxes or letters.

We have to check with insurance companies in dealing with the information of quantity, value and voyage, for example, when are cargos loading on board?, where are cargos stowed?, what requests for stowing?

Make sure that all relevant information is showed to the insuer, including characteristics of cargos, on board properties and the details of ship age.

When we hand over the insurance slip to the insuer, we must keep a written copy so as to prove that the insurance slip has been timely handed over to the insuer. Information on the written copy must be clear and correct. The important information is even not be ruined or missed.

Words on the insurance slip must be in accordance with those on the insuer’s standard slip.

When there is agreement between both insurance, insurance agent should arrange insurance slip as soon as possible.